Handling probate in California can feel overwhelming, especially if you have never done it before. Every county follows the same legal framework but has its own local rules, forms, and timelines. This guide explains exactly how probate works in California, what steps you must take, and how long it usually takes to close an estate.

You will learn how to file probate, what forms to use, how to calculate fees, and when you can handle probate yourself. Each section provides clear answers based on California law and official court resources.

In California, more than 60% of estates require some level of probate, and average cases last 9 to 18 months. Executors are responsible for a significant amount of paperwork, including filing court forms, sending required notices, tracking deadlines, and maintaining accurate records throughout the process.

Source: California Courts

This guide will help you file probate correctly, but probate is just one part of settling a loved one’s affairs. Executors must also locate assets, notify institutions, cancel services and subscriptions, negotiate debts, prepare final tax filings, close accounts, update deeds and titles, and coordinate distributions… all while staying compliant with California law.

While this guide equips you to handle probate on your own, many families choose Alix, a full-service estate settlement team that files your probate forms and manages the heavy administrative tasks that follow, helping you settle the entire estate accurately and efficiently.

Probate is the court-supervised process that ensures a deceased person’s assets are collected, debts are paid, and the remaining property is distributed according to the law. The California Probate Code (7000-7350) defines this process and the duties of executors and administrators.

The court’s main role is to validate the will (if there is one), appoint an executor or administrator, and oversee the estate’s administration until everything is settled.

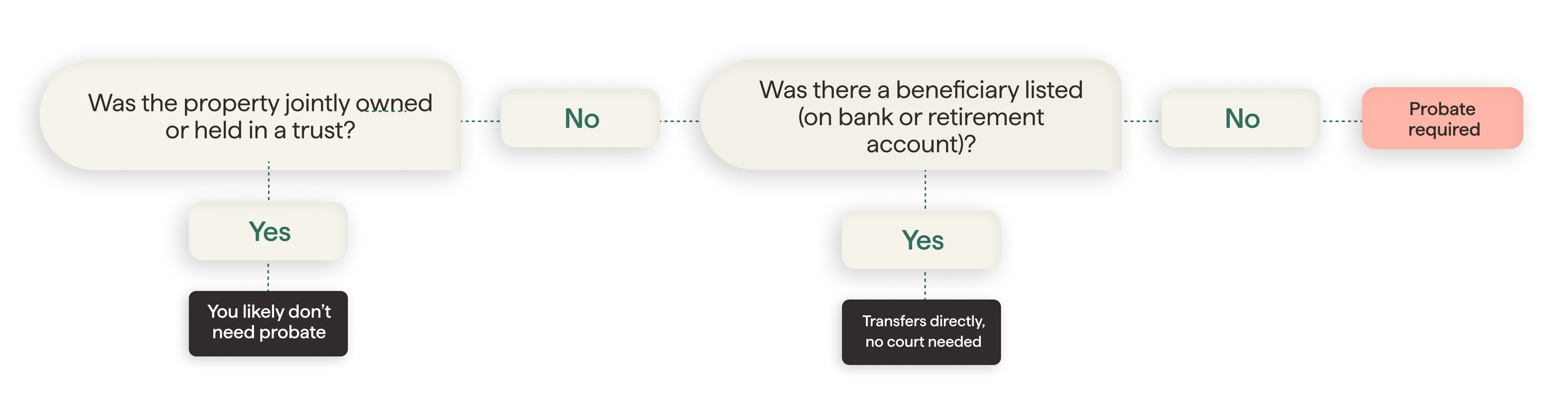

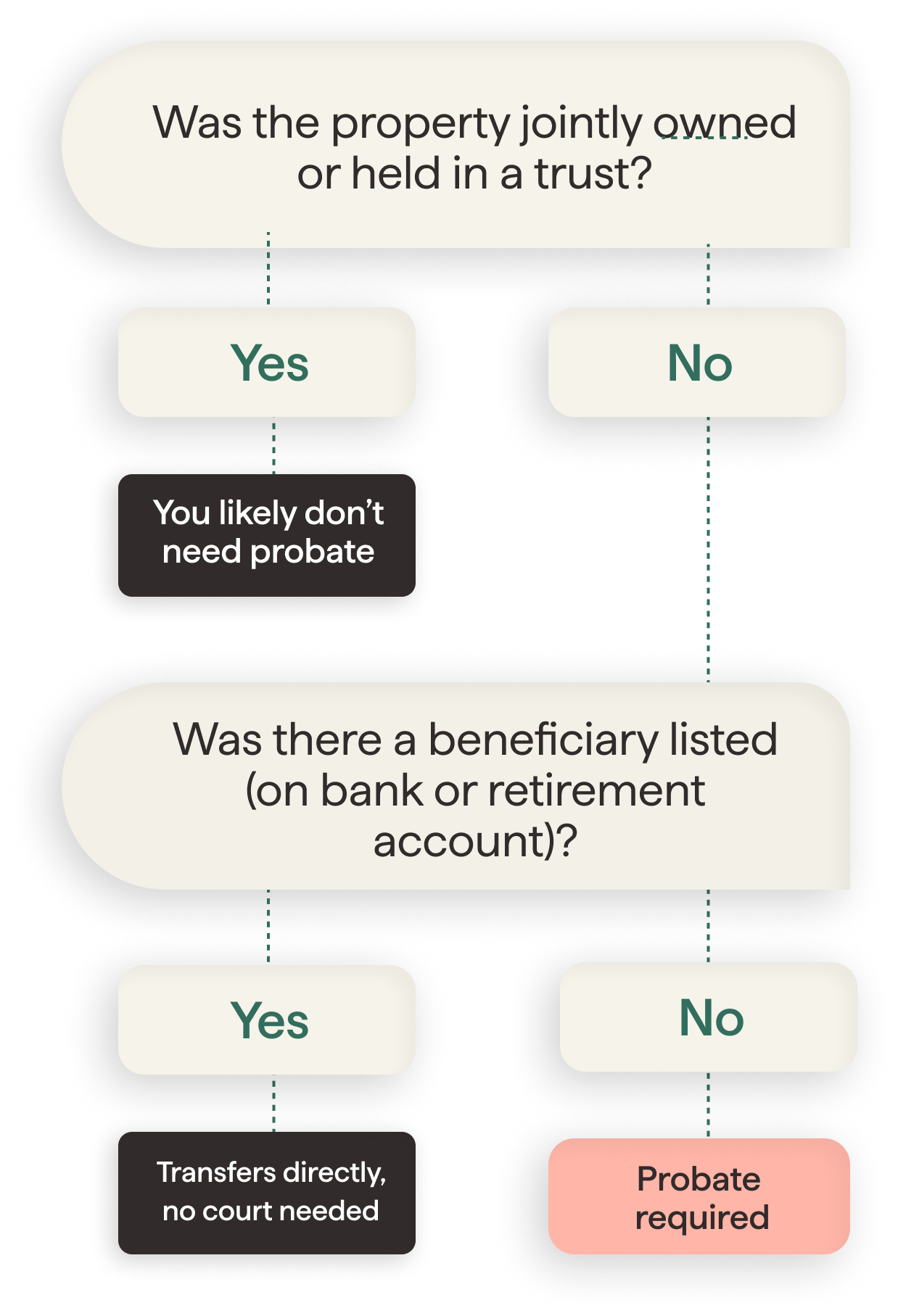

Probate is generally required in California when a person dies owning assets in their name alone and the total value of those assets is above the state’s small estate threshold. The threshold depends on what type of property the estate contains and the decedent’s date of death.

For personal property (bank accounts, vehicles, household items, stocks, etc.) a simplified procedure may be available if the estate’s value is below a specific limit set by Probate Code sections 13100–13101.

If the person died on or after April 1, 2022 and before April 1, 2025, the personal property limit is $184,500.

Estates at or below this amount may qualify for a Small Estate Affidavit procedure instead of full probate.

For real property, the limits are different and generally much lower. Under Probate Code sections 13151/13154, a simplified real property transfer is only available if the property’s value falls under the state-set real property thresholds.

If the estate exceeds the applicable limits, or if it contains solely-owned real estate, formal probate is usually required.

According to the California Courts Self-Help Center, probate is required whenever real property or other assets must be legally transferred under court supervision.

Some assets bypass probate entirely, such as:

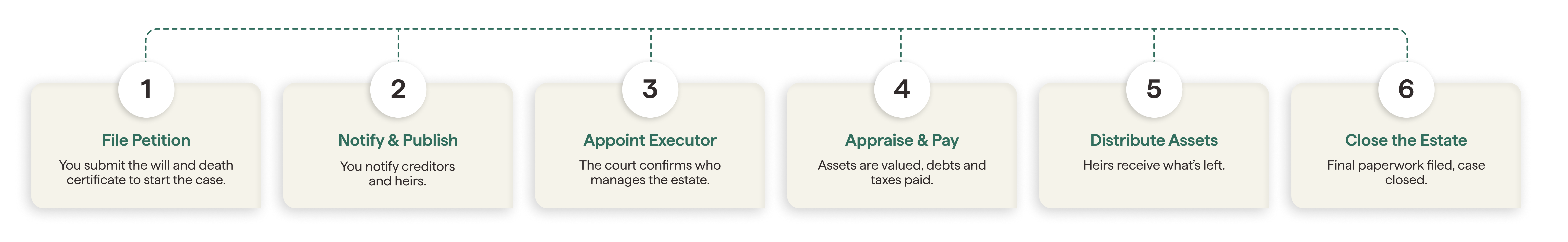

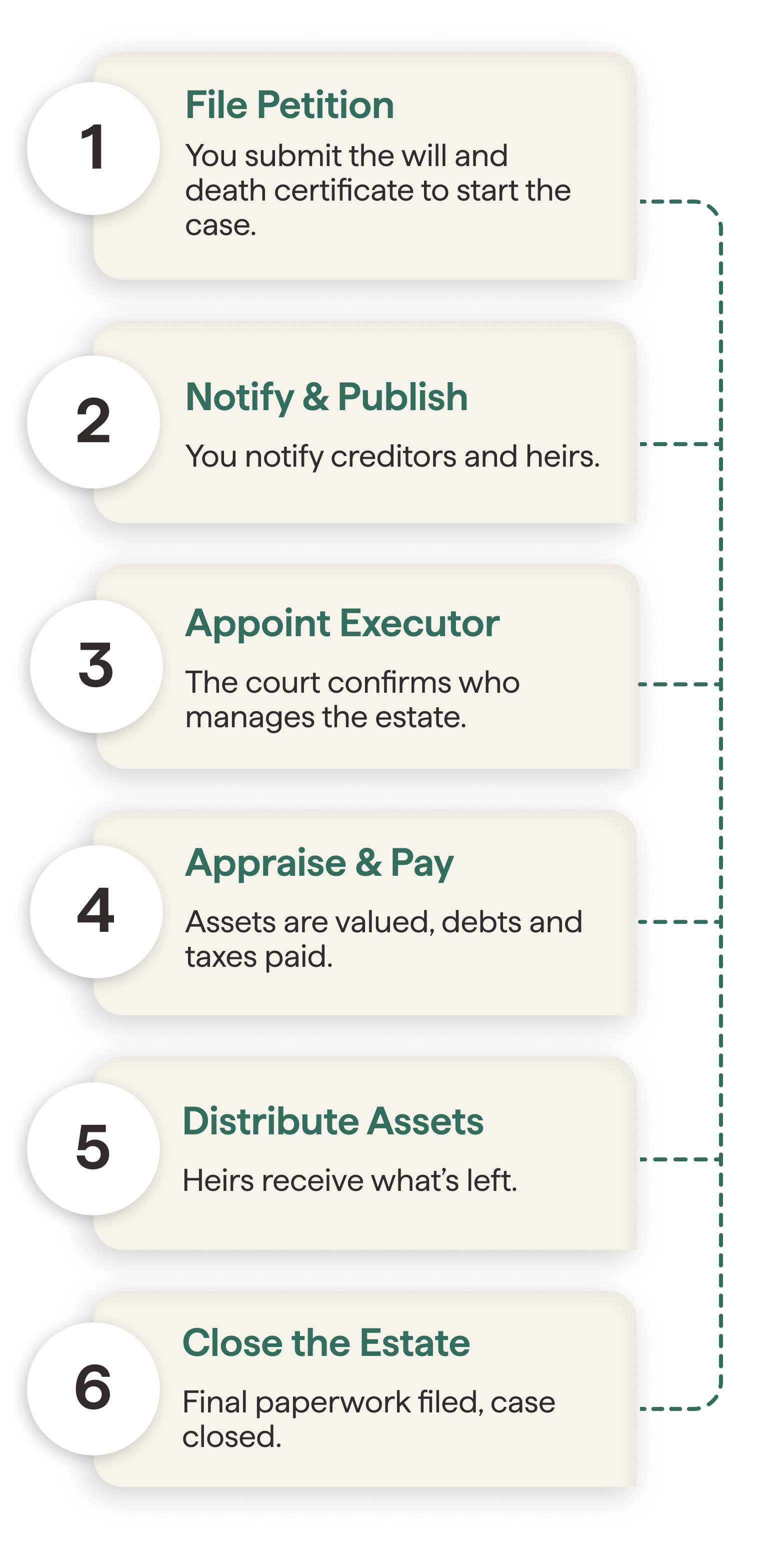

The official petition to open probate (Form DE-111) and all related filings are available through the Judicial Council of California. Each step below follows the guidance outlined in the California Courts Probate Guide.

File a Petition for Probate (Form DE-111) in the Superior Court where the deceased person lived. You can download the form directly from the California Judicial Branch website.

Mail required notices to all beneficiaries and publish a public notice to creditors in a local newspaper.

In California, the court holds a hearing to approve the personal representative. Once approved, the court issues Letters Testamentary (if there is a will) or Letters of Administration (if there is no will). These documents grant authority to act on behalf of the estate.

Complete Form DE-160 (Inventory and Appraisal) to list all assets and their values. File it with the court.

Use estate funds to settle debts, file final tax returns, and pay any remaining bills.

Prepare a Final Accounting that shows all assets collected, expenses paid, and proposed distributions. Submit this accounting to the court for review.

After the accounting is reviewed, file a Petition for Final Distribution. Once the court approves it, you may distribute the remaining assets according to the will or California intestate laws and officially close the estate.

Estimated timeline for Probate in California

Simple estates: 6 to 9 months.

Typical estates: 9 to 18 months.

Complex estates: 18 months or longer.

| Stage | Estimated duration | Key actions | Common delays | Alix tip |

|---|---|---|---|---|

| 1. File the petition | 1-2 months | File Form DE-111 and death certificate. Publish notice to heirs and creditors. | Missing notices or deficiencies in the petition. | We help you prepare and file correctly the first time. |

| 2. Executor appointment | 1-2 months | Letters are issued after the hearing. | Court backlog. | Track your appointment and set alerts for hearing dates. |

| 3. Inventory & appraisal | 3–4 months after appointment | File Form DE-160 and obtain valuations. | Waiting for the probate referee or missing accounts. | Use our checklist to gather all financial records. |

| 4. Debts, taxes & claims | 4–8 months | Notify and pay creditors; file IRS 1040 & 1041. | Unresolved debts or tax extensions. | We monitor tax filings and keep deadlines on track. |

| 5. Distribution & closing | 2–4 months | File final accounting, attend hearing, get approval for final distribution, submit receipts, close estate | Incorrect accounting, missing information from petition for final distribution | Guided final accounting and compliance review. |

The average probate case in California takes between 9 and 18 months depending on the size and complexity of the estate, according to recent data from the National Center for State Courts (NCSC). Larger counties such as Los Angeles or San Francisco may take longer because of high caseloads.

Cases may take longer if:

Most California estates spend between 3% and 7% of total estate value on probate costs. Filing fees typically range from $435 to $1,000, as listed by the California Superior Court fee schedules. Executor and attorney fees follow the percentages defined under Probate Code 10800.

Typical fees include:

Probate in California follows a statutory fee schedule that defines how much executors and their attorneys can be paid. These fees are set by California Probate Code 10800 and apply to the total gross value of the estate, not just the liquid cash.

Current statutory fee rates:

Example: If an estate is worth $600,000, both the executor and the attorney are each entitled to $15,000 in statutory fees (4% of the first $100k, 3% of the next $100k, and 2% of the remaining $400k).

In addition, courts may approve extraordinary fees for special services such as selling real property, handling tax issues, or resolving litigation. These are generally billed hourly and must be justified to the court.

Traditional law firms in California charge according to this schedule, meaning costs often rise with the size of the estate. Alix works differently, offering a flat, predictable fee that covers the same filings, court coordination, and communication for one fixed price.

| Category | Traditional Law Firm | Alix |

|---|---|---|

| Billing and Cost | Hourly or percentage of estate | Flat, transparent fee |

| Process Management | Executor and attorney coordinate separately | Centralized, guided support |

| Communication | Limited, often billed hourly | Dedicated Care Team included |

| What’s included | Legal Probate by hourly billing | Probate and all estate settlement process for one flat fee |

| Client Experience | Complicated and time-consuming | Simple, accurate, and efficient |

In California, you can represent yourself in probate whether the case is uncontested or contested.. This is known as pro se representation.

However, probate involves strict rules, deadlines, and legal paperwork. Even a small mistake can delay the process for months or lead to rejected filings. Many executors choose professional assistance to ensure accuracy and compliance while avoiding high attorney fees.

The California Courts Self-Help Center confirms that executors can file documents, publish notices, and appear at hearings without an attorney

The California Judicial Council provides all official probate forms online. The most common ones include:

You can find all official forms at California Courts Probate Forms.

Probate cases are handled by the Superior Court in the county where the deceased person lived.

You can locate your local probate court here:

Find My California Superior Court

If the estate’s total value is under $184,500, you may qualify for Summary Probate, also called “Small Estate” or “Simplified Procedure.” Details are outlined by the California Courts Small Estate Guide, which explains how to use simplified procedures and required forms.

This process typically takes a few months and requires fewer court hearings. Executors can often file a Small Estate Affidavit instead of going through formal probate.

California allows a faster, simpler process for small estates. Here’s how to know if you qualify.

| Category | Simplified Probate (Small Estate) | Full Probate (Formal Process) |

|---|---|---|

| Estate Value | Under the small-estate thresholds (Including the current $184,500 limit for most estates; other limits may apply based on date of death and property type.) | Above small-estate thresholds |

| Court Hearings | County-specific | Multiple required |

| Typical Duration | 2–4 months | 9–18 months |

| Key Form | DE-305 (Small Estate Affidavit) | DE-111, DE-160, DE-174 |

| Executor Required? | No, based on heirs at law | Yes, court-appointed |

| When It’s Best For | Estates that qualify | Larger or complex estates |

| Outcome | Assets transferred directly | Full court-supervised process |

Do all estates have to go through probate in California?

No. Many smaller estates can use simplified procedures.

Most estates under $184,500 may qualify for small-estate options, but this is only one of several thresholds. California offers different limits based on the date of death, the type of assets, and whether the property is real estate or personal property.

Assets held in trusts, joint ownership, or with named beneficiaries usually transfer outside probate.

How long after death do you have to file probate?

California law recommends probate to be filed within 30 to 60 days after locating the will or confirming that there is no will.

Can probate be avoided with a trust?

Yes. The State Bar of California confirms that assets held in a revocable living trust bypass probate entirely.

Who pays probate costs?

To start probate, you need DE-111, DE-147, DE-140 (proposed order), and if applicable, DE-142 (waiver of bond).

What forms are needed to start probate?

All probate costs are paid from the estate’s funds, not by the executor personally.

What happens if there is no will?

If someone dies without a will, the court applies California’s intestate succession laws to determine who inherits the property.

According to a 2023 AARP study, more than 70% of executors describe probate as “confusing” or “time-consuming.” Alix was created to simplify that experience through guided support and flat, transparent pricing.

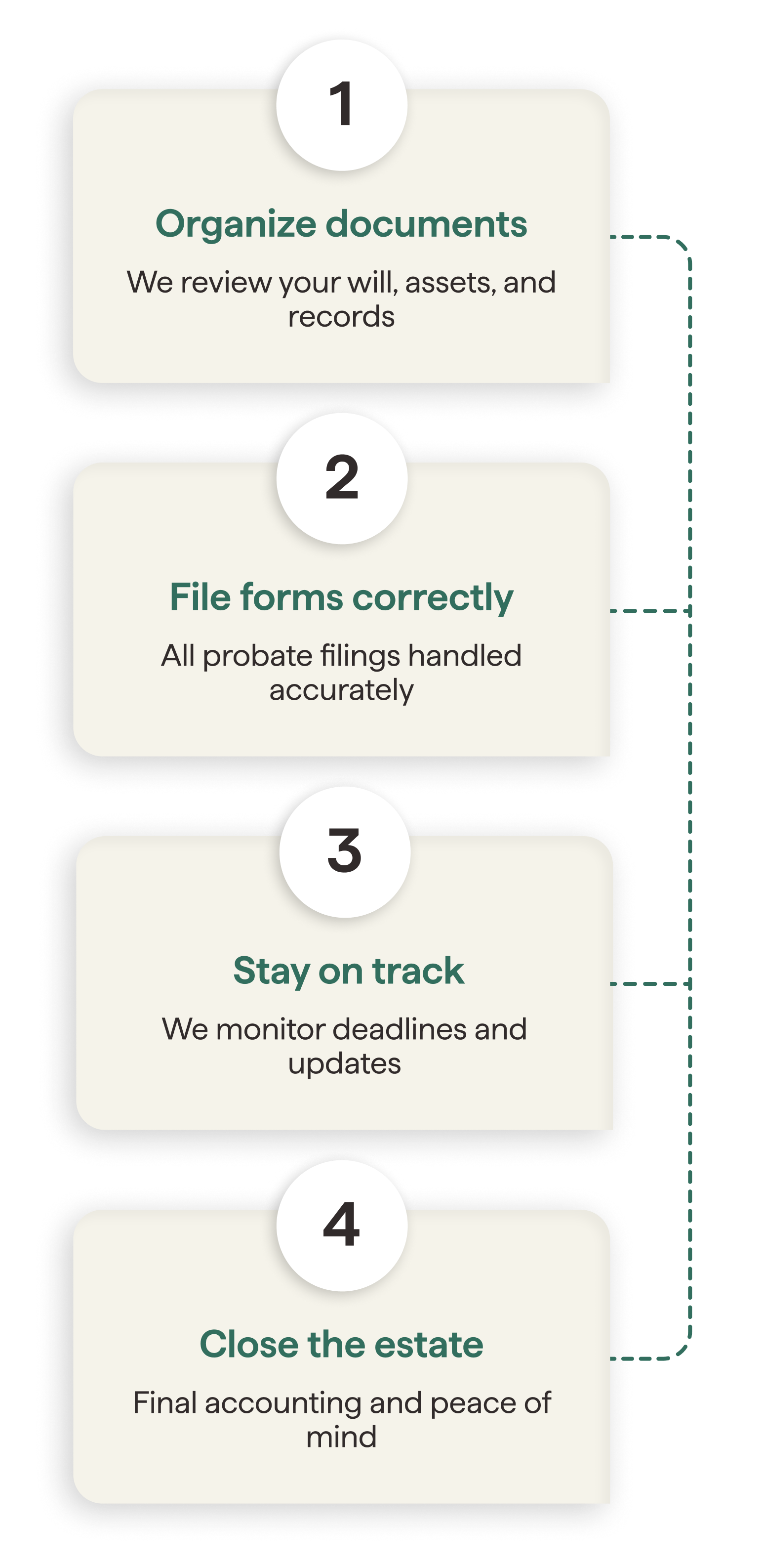

Alix helps families across California navigate the probate process from start to finish. Our team reviews every form, ensures compliance with court requirements, and keeps you informed throughout the process.

| Benefit | Description |

|---|---|

| Save Time | File forms correctly the first time and avoid costly delays |

| Stay Organized | Access a secure portal with all documents in one place |

| Reduce Costs | Flat-rate pricing, no hidden hourly fees |

| Get Expert Guidance | Dedicated Care Team available every step of the way |

Ready to get help with Probate in California?

Probate

8min Read

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Name Surname

September 2025

Probate

8min Read

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Name Surname

September 2025

Probate

8min Read

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Name Surname

September 2025